Nvidia’s $20B Groq Deal: How IP Moats Commanded the Highest Acqui-Hire Price Ever

A Deep Dive into the Power of Intellectual Property in Acqui-hire Deals

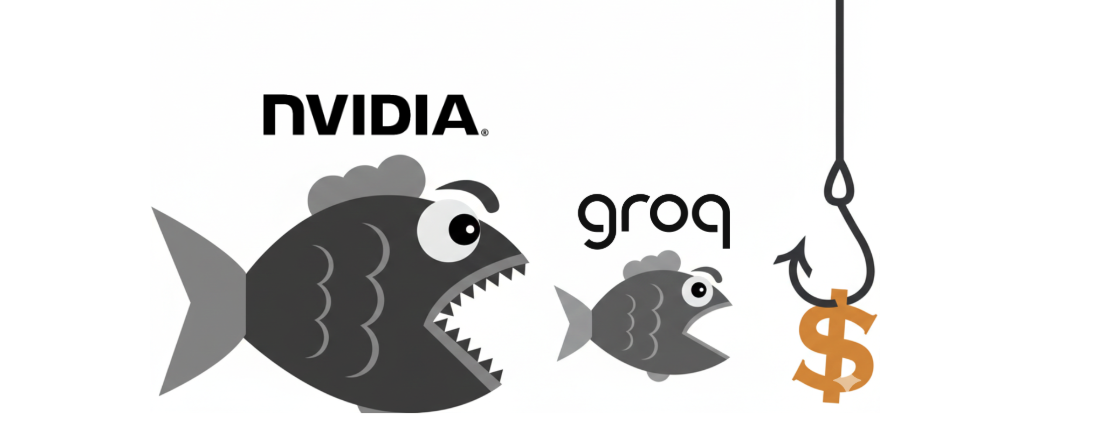

In this blog post, we explore how Groq’s robust IP moats enabled it to secure a record-breaking $20 billion deal with Nvidia—despite the transaction being structured as a non-exclusive IP license and a talent acqui-hire, rather than a traditional acquisition.

In our July 1, 2025 post, “Securing AI Talent in AI Startups by Using IP Moats,”[1] we highlighted how AI startups without strong patent portfolios often face lower-valued acqui-hire offers. Founders and investors miss out on significant returns when their companies lack IP defenses. We argued that strong IP protection not only discourages cheap acqui-hires but can also drive up deal values.

Fast forward to our July 21, 2025 update, “Acqui-Hiring is Heating Up,”[2] where we reported that acqui-hiring was accelerating. Sophisticated buyers were using these deals to achieve acquisition-like outcomes, securing a target company’s talent and IP while sidestepping the premium prices and regulatory scrutiny of full acquisitions.

Now, the Nvidia-Groq deal makes it crystal clear: IP moats matter. While eight-figure investments aren’t uncommon in frontier AI, they’re usually reserved for full acquisitions.[3] Nvidia is paying a record $20 billion not for an outright acquisition, but for a non-exclusive license to Groq’s IP and for Groq’s founder and key team members to join Nvidia.[4] The kicker? Groq will remain independent, and GroqCloud, its high-performance AI inference platform, will keep developing without interruption.

Groq’s patents and other IP on advanced inference technology (and the personnel to integrate them) are precisely what Nvidia needed to boost its AI stack capabilities.[5] This deal sets a new benchmark for the highest price paid for a non-exclusive IP license.

In our upcoming post, we’ll break down how Groq’s IP moats created a formidable barrier to Nvidia’s ambitions to improve its inference capability, forcing Nvidia to shell out $20 billion for a non-exclusive license and a slice of Groq’s top-tier talent. Stay tuned!

By Bob Steinberg, Jacob Levine

Bob Steinberg is the Founder of Generative IQ® LLC, a venture fund that provides capital to early-stage IP rich AI start-ups. He has been protecting and litigating IP rights, working with technology entities and entrepreneurs navigating the IP landscape and monetizing blocking rights for over 30 years.

Jacob Levine is a J.D. Candidate 2027 at Harvard Law School where he serves as a Project Director for the Harvard Law Entrepreneurship Project. He graduated from American University in 2022 in the Global Scholars Program with dual degrees in Computer Science and International Studies. Jacob enjoys playing basketball and jazz music, woodworking, weight training, and reading. He loves to go on backpacking excursions with family and friends and attend concerts.

[1] https://generativeiq.com/securing-ai-talent-in-ai-startups-by-using-ip-moats/.

[2] https://generativeiq.com/july-update-acqui-hiring-is-heating-up/.

[3] https://intuitionlabs.ai/articles/nvidia-groq-ai-inference-deal

[4]https://www.wsj.com/business/deals/nvidia-20-billion-groq-deal-9f8d3a5b?gaa_at=eafs&gaa_n=AWEtsqc6bkN-LDKEK6L7qoloxSxKPdCngDu-Kq0fZulzC3iQ_nEqHt50QYDoa34vt0I%3D&gaa_ts=697040a5&gaa_sig=J6WeJ_xfq8ANY9hwOMBThRjBtQ0rsmRhBdAsF5oViiKU2ppj0oyvr4jMat36oIL2B9lxTQmsDkyH4N4nBAC57g%3D%3D.

[5] See e.g., https://www.fool.com/investing/2025/12/28/nvidia-groq-deal-acquisition-ai-inference-lpu/ (calling the deal “[a]s close to an acquisition as it gets”)